The Funding Gap: What’s Really Holding MSMEs Back?

While multiple funding mechanisms exist in theory, in practice, many MSMEs remain underfunded or entirely excluded from formal financing channels. The most common barriers include:

- High collateral requirements

- Limited or no credit history

- Weak financial documentation

- Informal business operations

- Lack of awareness about available programmes

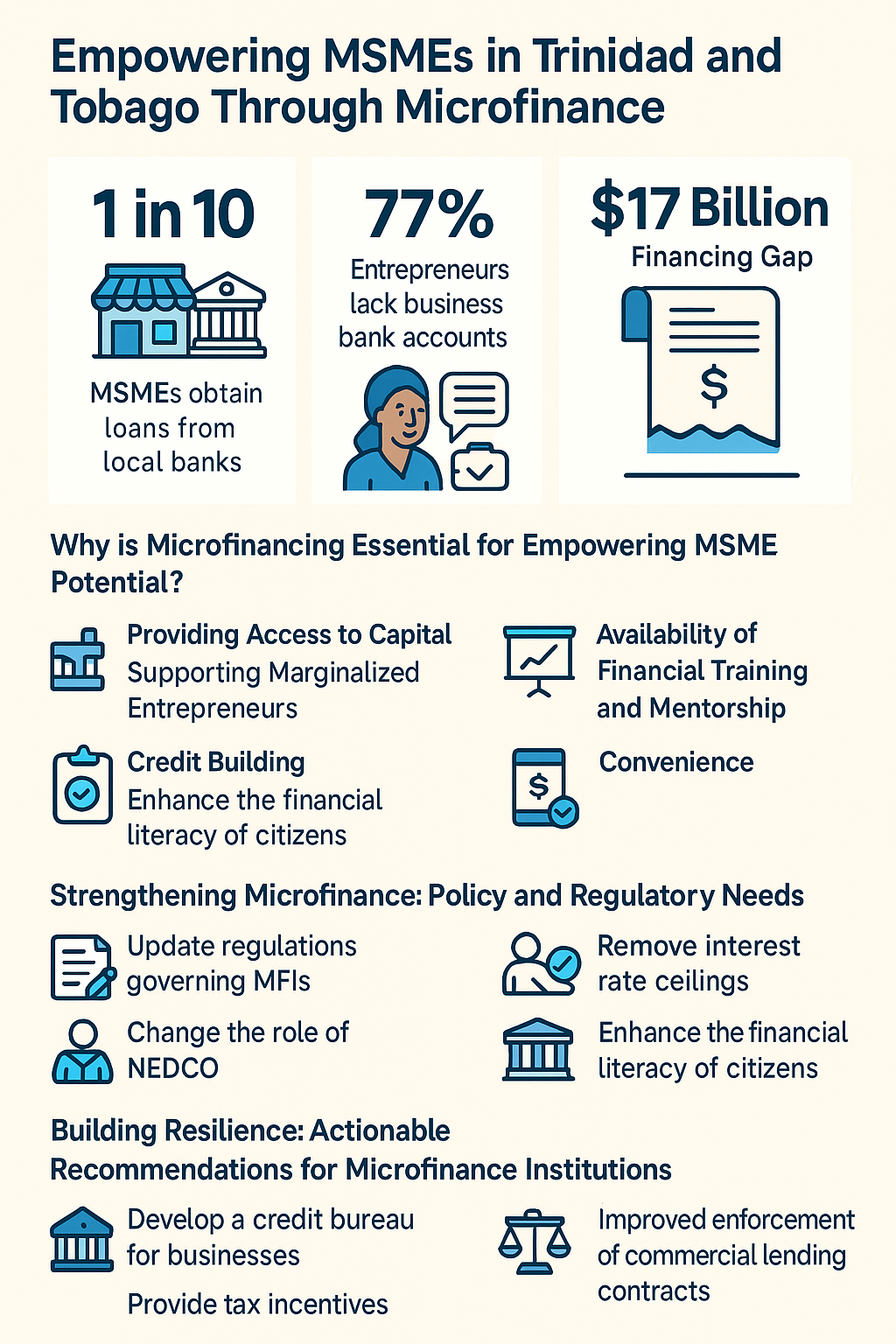

A January 2025 article by Dr Christian Stone, Chief Executive Officer, Term Finance SME states, “Micro, small, and medium-sized enterprises (MSMEs) in Trinidad and Tobago (T&T) struggle to access traditional financing, with only one in ten securing loans from local banks. A recent Trinidad and Tobago International Financial Centre survey shows that 77% of entrepreneurs lack business bank accounts, creating an estimated $17 billion financing gap for MSMEs.”

(Read full article here: https://www.ttifc.co.tt/web/how-microfinance-supports-tts-entrepreneurs/)

Key MSME Funding Options Available

Government Grants & Support Programmes

▪️ National Entrepreneurship Development Company (NEDCO)

Offers loans up to TT$500,000 with business development training. Their Business Accelerator Programme is critical for first-time entrepreneurs. Note: First-time borrowers can access up to TT$250,000 while repeat borrowers can access funding up to TT$500,000. NEDCO’s interest rate is fixed at 8 % (simple interest).

▪️ Agriculture Development Bank (ADB)

Provides financing for agri-based MSMEs — including crop farming, livestock, and agro-processing.

▪️ Eximbank T&T – Forex Facility

Helps manufacturers and exporters access foreign exchange to import essential inputs.

▪️ Ministry of Youth Development & National Service (MYDNS)

Youth Agricultural Homestead Programme and other initiatives fund youth entrepreneurship.

Private Sector & Microfinance

▪️ Credit Unions

Flexible, community-driven lending with more personalized assessments. Ideal for early-stage businesses with limited collateral.

▪️ Angel Investors / Venture Capital (Emerging)

Though not yet widespread, there is increasing interest in startup funding via Caribbean diaspora and business networks. Programmes like CARIRI’s Business Hatchery and Launch RockIt help bridge the gap.

Regional & International Funding

▪️ Caribbean Development Bank (CDB)

Offers grant funding and soft loans through intermediaries for innovation, resilience, and digital transformation.

▪️ Inter-American Development Bank (IDB Lab)

Partners with local organizations to fund social innovation, green business, and digital finance projects.

▪️ UNDP and EU Initiatives

Occasional grant opportunities targeting women, green energy, digital literacy, and post-COVID recovery.

How MSMEs Can Strengthen Their Access to Capital

Access to funding is not only about availability, it’s also about readiness. Here’s what entrepreneurs can do to improve their chances:

- Formalize the business – Register with the Companies Registry and BIR.

- Prepare proper documentation – Business plan, cash flow projections, and financial statements.

- Build a credit profile – Start with small loans or credit union accounts.

- Join an incubator or accelerator – These offer funding connections and capacity-building.

- Apply for business mentorship or training programmes – Many funders prefer to lend to entrepreneurs who’ve gone through structured training.

The Role of Policy and Ecosystem Development

While entrepreneurship has been politically prioritized, access to capital needs deeper systemic reform:

- Expand Credit Guarantee Schemes to reduce risk for lenders.

- Simplify application processes for MSME grants and loans.

- Improve financial literacy through nationwide programmes.

- Create a national startup fund backed by public-private partnerships.

- Digitize MSME support with centralized portals for funding access, application tracking, and mentoring.

MSMEs in Trinidad and Tobago are not short on ideas, ambition, or resilience; they are short on capital. As a nation, unlocking this capital is not just a financial imperative, but a social one.

With the right tools, partnerships, and policy environment, we can build a truly inclusive and innovative entrepreneurial economy.

Source: The Plight of the Small Business – Navigating Challenges in the Caribbean by Cherise Castle.

Entrepreneurs must get ready, but our institutions must also meet them halfway.

Infographic representing Dr. Stone’s article for easy referencing courtesy The Timely Entrepreneur. No copyright infringement intended.